Eligibility for the Disability Tax Credit is dependent upon Basic Activity of Daily Living (BADL), how an individual is affected on a daily basis. There are many different categories one may be eligible to claim the DTC under. Click on the BADL (Basic Activity of Daily Living) for specific examples.

Disability Tax Credit

The Disability Tax Credit (DTC) is a non-refundable tax credit (meaning your refund is based on your taxable income, OR that of a supporting family member/spouse) that is retroactive up to 10 tax years. This means that it is possible to receive a refund dating back up to 10 years based on the federal/provincial tax you have paid on your income tax returns.

Basic Activity of Daily Living (BADL)

Note: The Canada Revenue Agency (CRA) is the governing body to determine eligibility. If you feel you may be eligible, speak with your physician and ask them to complete form T2201. Some physician’s may not have a fulsome understanding of eligibility requirements, but ultimately – the CRA is the one to determine your eligibility. If you have previously applied and have been denied, do not be discouraged! You can always re-apply and be sure to include relevant information showing specifically how you are justifying the requirements listed above.

In the event you want professional help obtaining the Disability Tax Credit, there are a number of different service providers throughout Canada that specialize in this process and will work directly with your physician as well as the Canada Revenue Agency on your behalf.

We recommend that prior to engaging any professional services that you do your due diligence and check with the Better Business Bureau to ensure they are a reputable organization.

Do I Qualify?

In order to be eligible to open a Registered Disability Savings Plan (RDSP) there are a few requirements.

Individual’s wishing to open a Registered Disability Savings Plan also must:

- Hold a valid Social Insurance Number (SIN).

- Be a Canadian resident.

If you are unsure if you are currently eligible to claim the Disability Tax Credit, there are a few options you have to check your eligibility:

1

You must currently be eligible to claim the Disability Tax Credit.

2

Although you can open an RDSP until the age of 59, due to the 10-year repayment rule you must be under the age of 49 to receive grants & bonds.

Step 1

Go to Government of Canada website and log in.

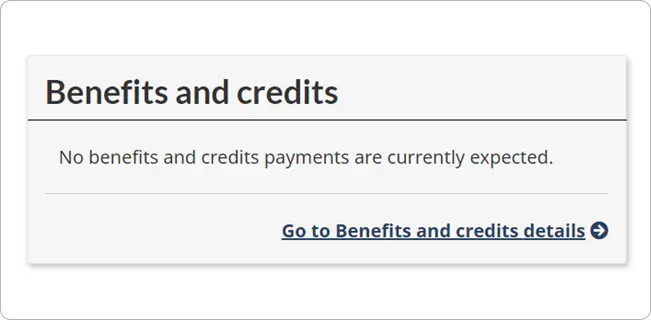

Step 2

From the home page, click on “Go to Benefits and credits details”.

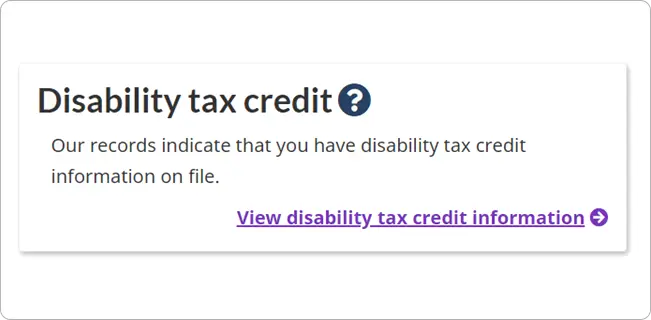

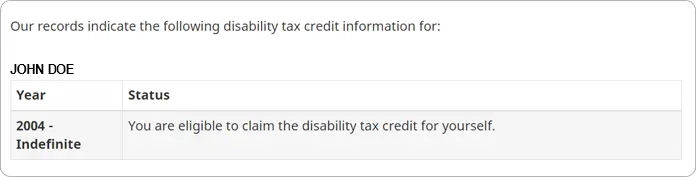

Step 3

Click on “View disability tax credit information”.

This will tell you if you are currently eligible to claim the Disability Tax Credit.

Please note: If you do not have access to your CRA My Account, you can always call the CRA directly on their general inquiries line at 1-800-959-8281. Wait times can often be quite significant, and be prepared to answer security questions with an agent to verify your account. This may include personal information such as your SIN, or information from a previous tax return.

Learn about RDSPs

Have a question? We are here to help!

Please send us a message or schedule some time with us, we are happy to assist!